The July 2013 business figures showing stability in freight volumes, but continued rate weakness.

Below is a summary of transportation industry numbers from Sylectus.

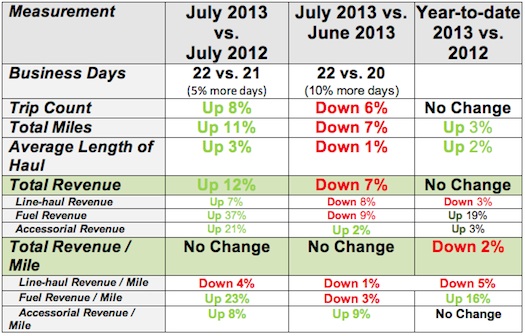

July 2013 vs. July 2012: The numbers below need to be adjusted for business days. July 2013 had 1 more (5% more) business day (July 2013 had 22 business days vs. July 2012 had 21 business days). Taking this into account, July 2013 was actually marginally stronger than July 2012. Line-haul rates continue to show weakness, even though capacity numbers are showing a relative stability. See charts below for more information. Good news … this is the 2nd month in a row where we see year-over-year revenue growth and volume. Bad news … rates are still below prior years.

July 2013 vs. June 2013: The numbers below need to be adjusted for business days. July 2013 had 2 more (10% more) business days (July 2013 had 22 business days vs. June 2013 had 20 business days). July tends to be one of the weakest (if not the weakest) business month of the year compared to June which tends to be the strongest. Even though the charts below show a modest 6% decrease in revenue month-over-month, if we take into consideration the number of business days, the decline is probably closer to 12-15% month over month. But don’t be alarmed about this decrease! Again, July tends to be one of the slowest business months of the year.

Our numbers actually show July 2013 to be one of the strongest July months since we started tracking our data.

We continue to see (and hear about) softness in the rate-per-mile and we are tracking 2011 numbers and below 2012 numbers in terms of rate/mile. The charts and graphs below clearly show this “flattening” trend.

The Year to Date figures show that business volumes are running about the same as last year. Due to a stronger July, business volumes and revenues are now tracking 2012 numbers, but rates are slightly behind last year (a common theme).

Capacity is continues to lag and has still not reached 2007 levels. It is odd that the Sylectus “spot market” rate is slipping while other transportation sources are showing modest increases in revenues and revenue per mile.

Truck Searches and Load Postings: It seems that the members of the Alliance continue to leverage the network for variable capacity needs rather than recruit more trucks/drivers. Truck searches are up 40% year over year and Load Postings are up 45% year over year.

Here are the metrics in a table format (note … to be included in the data analysis, companies had to be on our system for all reporting periods):

Breakout of Revenue by Revenue Type:

In the above table, we show changes in TOTAL revenue and then the changes in the components of total revenue (line-haul, fuel and accessorial). Here is the breakout by percentage of Total Revenue.

- Line-haul revenue represents 75.9% of the total revenue

- Fuel revenue represents 12.3% of the total revenue

- Accessorial revenue represents 11.7% of the total revenue.

Chart Analysis:

If you look at the table below … you will see that Line-haul revenue per mile in 2008 was in the $1.50 to $1.60 per mile. In 2009 the Line-haul revenue per mile has slipped as low as $1.25 before rebounding to the mid $1.40 range. 2011 rebounded and ended the year nicely, and 2012 has continued the good rate structures of 2011, even surpassing the 2008 high months that were affected by the high price of fuel. However, over the past few months, we have seen an erosion of the line-haul rate/mile.

The good news is that “fuel rate per mile” has been steady for 2013.

At the “total revenue per mile”, 2013 is tracking below 2012 and the “line-haul rate per mile” is lower than 2012 and more in line with 2011.

The following data / chart shows 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012 and 2013 in terms of total revenue per mile, line-haul revenue per mile, accessorial revenue per mile and fuel revenue per mile.

Total revenue per mile is a combination of

- Line-haul revenue per mile,

- accessorial revenue per mile and

- Fuel revenue per mile.

The charts below show Revenue per Mile for the past 8 years. We the show 4 charts of:

- Total Revenue per mile (numbers include line haul, accessorial and fuel)

- Just “Line haul” revenue per mile (rates have been relatively stable since June 2011).

- Just Fuel revenue per mile (rates have stabilized since the 2008 fuel spike, but are starting to rise now).

- Just Accessorial revenue per mile.

Sylectus created a graph to try and compare how the “Load Index” (Demand) and “Truck Count Index” (Supply) compares with the “Dow Jones Index”.

The “Load Index” (Demand) is the combined load counts of a subset of our customers normalized to an index value. A value of 1.0 is normal. A value of 1.2 is 20% above normal. A value of 80 is 20% below normal. We started recording the index on December 1, 2006, so we have over 6 years of data in the index now.

The “Truck Index” (Supply) is the combined fleet counts of a subset of the same “load index” customers normalized to an index value. A value of 1.0 is normal. A value of 1.2 is 20% above normal. A value of 80 is 20% below normal. We started recording the index on December 1, 2006, so we have over 6 years of data in the index now.

We took the closing value of the Dow Jones Industrial Average (DJIA) and used the same process to normalize the data (we did this by using the same “measurement period” for calculating the normalization value). Just like the “Load Index” and “Truck Index”, the “normalized DJIA” will have a value of 1.0 being normal and value of 1.2 is 20% above normal (etc.).

Below you will find the two normalized indexes charted from December 1, 2006 through to current date. The BLUE LINE is the “Load Index” (Demand), the GREEN LINE is the “Truck Index” (Supply) and the RED LINE is the “normalized DJIA”

Sources:

- “Sylectus Index” – Summary of data from Sylectus companies.

- “Dow Jones Industrial Average” – Yahoo database of Dow Jones closing values ( http://finance.yahoo.com/q/hp?s=%5EDJI&a=09&b=1&c=2006&d=02&e=31&f=2009&g=d).

So what does this chart tell us?

1. Supply of trucks (capacity) continues to lag below demand and was slowly recovering but has reversed that trend. It is back down below pre-recession levels.

2. The Demand (loads) chart is tracking better than 2007. 2010 and 2011 were great rides. 2012 started out ahead of the same period last year, but the last 6 months of 2012 tracked 2011. 2013 is now slightly below 2012.

LOAD INDEX – 2007-2013

Below you will find the same 2007, 2008, 2009, 2010, 2011, 2012 and 2013 numbers used in the first graph, except the data is shown year-over-year.

Consider the following graph which shows the daily “Load Index” for January 2007 through to current 2013. We are starting to track 2011 since July.

The “Load Index” is the combined load counts of a subset of our customers normalized to an index value. A value of 1.0 is normal. A value of 1.2 is 20% above normal. A value of 80 is 20% below normal.

The green line shows the 2007 index value, the orange line shows the 2008 index value, the blue line shows the 2009 index value, the purple line tracks 2010, the gold line tracks 2011, the turquois line tracks the 2012, and the black tracks the 2013 number so far.

TRUCK SEARCHES – 2007-2013

Below you find the same 2007 through 2013 numbers for the number of TRUCK SEARCHES done on the system. 2013 continues to set monthly records for truck searches.

The green line shows the 2007 index value, the orange line shows the 2008 index value, the blue line shows the 2009 index value, the purple line tracks 2010, the gold line tracks 2011, the turquois line tracks the 2012, and the black tracks the 2013 number so far.

(Y axis = Number of Truck Searches done per business day)

LOAD POSTINGS – 2007-2013

Below you find the same 2007 through 2013 numbers for the number of LOAD POSTINGS done on Sylectus Load Board. 2013 continues to set monthly records for load postings on the private Alliance load board.

The green line shows the 2007 index value, the orange line shows the 2008 index value, the blue line shows the 2009 index value, the purple line tracks 2010, the gold line tracks 2011, the turquois line tracks the 2012, and the black tracks the 2013 number so far.

(Y axis = Number of Loads Posted per business day)

About Sylectus

Sylectus is trucking’s most powerful network. Born in the new, cloud-based economy, it’s built on one simple idea … leverage the resources of your competitors to achieve extraordinary results for your customers and for your company. Sylectus is more than Transportation Management Software. It’s a web-based, protected, wealth creation network for managing in the New Trucking Economy. Designed exclusively for progressive trucking companies, Sylectus enables them to bypass the investment and time continuum to grow fast NOW.